Currently released so far... 1947 / 251,287

Articles

Browse latest releases

2010/12/28

2010/12/27

2010/12/26

2010/12/25

2010/12/24

2010/12/23

2010/12/22

2010/12/21

2010/12/20

2010/12/19

2010/12/18

2010/12/17

2010/12/16

2010/12/15

2010/12/14

2010/12/13

2010/12/12

2010/12/11

2010/12/10

2010/12/09

2010/12/08

2010/12/07

2010/12/06

2010/12/05

2010/12/04

2010/12/03

2010/12/02

2010/12/01

2010/11/30

2010/11/29

2010/11/28

Browse by creation date

Browse by origin

Embassy Asuncion

Embassy Astana

Embassy Asmara

Embassy Ashgabat

Embassy Ankara

Embassy Amman

Embassy Algiers

Embassy Addis Ababa

Embassy Accra

Embassy Abuja

Embassy Abu Dhabi

Embassy Abidjan

Embassy Bujumbura

Embassy Buenos Aires

Embassy Bucharest

Embassy Brussels

Embassy Bridgetown

Embassy Brasilia

Embassy Bogota

Embassy Bishkek

Embassy Bern

Embassy Berlin

Embassy Belgrade

Embassy Beirut

Embassy Beijing

Embassy Bangkok

Embassy Bandar Seri Begawan

Embassy Bamako

Embassy Baku

Embassy Baghdad

Consulate Barcelona

Embassy Copenhagen

Embassy Conakry

Embassy Colombo

Embassy Chisinau

Embassy Caracas

Embassy Cairo

Consulate Casablanca

Consulate Cape Town

Embassy Dushanbe

Embassy Dublin

Embassy Doha

Embassy Djibouti

Embassy Dhaka

Embassy Dar Es Salaam

Embassy Damascus

Embassy Dakar

Consulate Dubai

Embassy Kyiv

Embassy Kuwait

Embassy Kuala Lumpur

Embassy Kinshasa

Embassy Kigali

Embassy Khartoum

Embassy Kampala

Embassy Kabul

Embassy Luxembourg

Embassy Luanda

Embassy London

Embassy Lisbon

Embassy Lima

Embassy La Paz

Consulate Lagos

Mission USNATO

Embassy Muscat

Embassy Moscow

Embassy Montevideo

Embassy Monrovia

Embassy Minsk

Embassy Mexico

Embassy Maputo

Embassy Manama

Embassy Managua

Embassy Madrid

Consulate Munich

Consulate Monterrey

Embassy Pristina

Embassy Pretoria

Embassy Prague

Embassy Port Au Prince

Embassy Paris

Embassy Panama

Consulate Peshawar

REO Basrah

Embassy Rome

Embassy Riyadh

Embassy Riga

Embassy Rangoon

Embassy Rabat

Consulate Rio De Janeiro

Consulate Recife

Secretary of State

Embassy Stockholm

Embassy Sofia

Embassy Skopje

Embassy Singapore

Embassy Seoul

Embassy Sarajevo

Embassy Santo Domingo

Embassy Santiago

Embassy Sanaa

Embassy San Salvador

Embassy San Jose

Consulate Strasbourg

Consulate Shenyang

Consulate Shanghai

Consulate Sao Paulo

Embassy Tunis

Embassy Tripoli

Embassy The Hague

Embassy Tel Aviv

Embassy Tehran

Embassy Tegucigalpa

Embassy Tbilisi

Embassy Tashkent

Embassy Tallinn

Browse by tag

CU

CO

CH

CDG

CIA

CACM

CDB

CI

CS

CVIS

CA

CBW

CASC

CD

CV

CMGT

CLINTON

CE

CJAN

CG

CF

CN

CIS

CM

CONDOLEEZZA

COE

CR

CY

COUNTERTERRORISM

COUNTER

EG

EFIN

EZ

ETRD

ETTC

ECON

EUN

ELAB

EU

EINV

EAID

EMIN

ENRG

ECPS

EN

ER

ET

ES

EPET

EUC

EI

EAIR

EAGR

EIND

EWWT

ELTN

EREL

ECIN

EFIS

EINT

EC

ENVR

EINVETC

ELECTIONS

ECUN

EINVEFIN

EXTERNAL

ECIP

EINDETRD

IV

IR

IS

IZ

IAEA

IN

IT

ICTY

IQ

ICAO

INTERPOL

IPR

INRB

IRAJ

INRA

INRO

ID

ITPHUM

IO

IRAQI

ITALY

ITALIAN

IMO

KNNP

KWBG

KU

KPAL

KGHG

KPAO

KAWK

KISL

KHLS

KSUM

KSPR

KDEM

KJUS

KCRM

KGCC

KPIN

KDRG

KTFN

KG

KBIO

KHIV

KSCA

KN

KS

KCOR

KZ

KE

KFRD

KTIP

KIPR

KNUC

KMDR

KPLS

KOLY

KUNR

KIRF

KIRC

KACT

KGIC

KRAD

KCOM

KMCA

KV

KHDP

KDEV

KWMN

KTIA

KPRP

KAWC

KCIP

KCFE

KPKO

KMRS

KLIG

KBCT

KICC

KGIT

KSTC

KNPP

KR

KPWR

KWAC

KMIG

KSEC

KIFR

KDEMAF

KFIN

MOPS

MARR

MNUC

MX

MASS

MCAP

MO

MIL

MTCRE

ML

MR

MZ

MOPPS

MTCR

MAPP

MU

MY

MA

MG

MASC

MCC

MK

MTRE

MP

MDC

MPOS

MAR

MD

MEPP

PGOV

PREL

PHUM

PINR

PTER

PINS

PREF

PK

PE

PBTS

POGOV

PARM

PROP

PINL

PL

POL

PBIO

PSOE

PHSA

PKFK

PO

PGOF

PA

PM

PMIL

PTERE

PF

POLITICS

PEPR

PSI

PINT

PU

POLITICAL

PARTIES

PECON

PAK

Browse by classification

Community resources

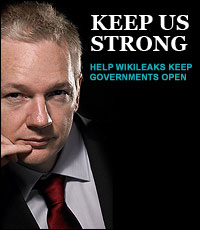

courage is contagious

Viewing cable 08LONDON2603, BROWN RECEIVES BOUNCE FROM BAIL-OUT PLAN;

If you are new to these pages, please read an introduction on the structure of a cable as well as how to discuss them with others. See also the FAQs

Understanding cables

Every cable message consists of three parts:

- The top box shows each cables unique reference number, when and by whom it originally was sent, and what its initial classification was.

- The middle box contains the header information that is associated with the cable. It includes information about the receiver(s) as well as a general subject.

- The bottom box presents the body of the cable. The opening can contain a more specific subject, references to other cables (browse by origin to find them) or additional comment. This is followed by the main contents of the cable: a summary, a collection of specific topics and a comment section.

Discussing cables

If you find meaningful or important information in a cable, please link directly to its unique reference number. Linking to a specific paragraph in the body of a cable is also possible by copying the appropriate link (to be found at theparagraph symbol). Please mark messages for social networking services like Twitter with the hash tags #cablegate and a hash containing the reference ID e.g. #08LONDON2603.

| Reference ID | Created | Released | Classification | Origin |

|---|---|---|---|---|

| 08LONDON2603 | 2008-10-15 14:02 | 2010-12-02 23:11 | CONFIDENTIAL | Embassy London |

VZCZCXRO6243

PP RUEHAG RUEHROV

DE RUEHLO #2603/01 2891403

ZNY CCCCC ZZH

P 151403Z OCT 08

FM AMEMBASSY LONDON

TO RUEHC/SECSTATE WASHDC PRIORITY 0078

INFO RUCNMEM/EU MEMBER STATES COLLECTIVE PRIORITY

RUEHBJ/AMEMBASSY BEIJING PRIORITY 1070

RUEHOT/AMEMBASSY OTTAWA PRIORITY 1177

RUEHKO/AMEMBASSY TOKYO PRIORITY 1176

RUEATRS/DEPT OF TREASURY WASHDC PRIORITY

RUEHC/DEPT OF LABOR WASHDC PRIORITY

RHEHNSC/NSC WASHDC PRIORITY

C O N F I D E N T I A L SECTION 01 OF 03 LONDON 002603

SIPDIS

EO 12958 DECL: 10/15/2018

TAGS ECON, EINV, PGOV, UK

SUBJECT: BROWN RECEIVES BOUNCE FROM BAIL-OUT PLAN;

INVESTORS STILL CAUTIOUS

Classified By: Classified by Acting Minister Counselor Kathleen Doherty for reasons 1.4 b and d.

¶1. (SBU) Summary: The U.K. government’s agreement to pump GBP 37 billion into three of Britain’s largest banks, along with similarly dramatic moves undertaken in the U.S. and in the rest of Europe, buoyed, at least temporarily, London’s stock markets, with minor gains posted in the first two days of this week. PM Gordon Brown’s stock has also risen in recent days, with the President of the European Commission Jose Manuel Barroso publicly calling the nearly Europe-wide, multi-billion dollar bank bail-out plan as “the Brown Plan,” and pundits across the political spectrum at home hailing the PM as “the man who saved the financial system.” Most in London are waiting to see if the recovery in stock market prices will be sustained throughout the week (the FTSE is down 4 percent in trading on October 15th) before even considering whether the “worst is over.” Bleak economic news continues to trickle in: U.K. inflation reached 5.2 percent in September, up .5 percent from August figures, with the annual rate of inflation of energy and other household utility bills reaching 15 percent - the highest since 1989. End Summary.

Pumping Up The Volume

---------------------

¶2. (SBU) Following a weekend of talks with Britain’s largest banks, HMG agreed to inject GBP 37 billion into three banks: Royal Bank of Scotland (RBS), Lloyds TSB and HBOS. The government will own a majority stake, up to 70 percent in RBS, and more than 40 percent in Lloyds and HBOS. The three banks have shelved their dividend payments on ordinary shares until they fully repay the GBP 9 billion in preference shares issued by the government. The banks will face restrictions on executive pay and have agreed to pay their 2008 executive bonuses in shares. (Comment: The restrictions on executive pay have been particularly welcomed by British unions, which have long-called for bonuses to be curbed. End Comment.) The government and the banks are in discussions about how many board seats the government will have and about other managerial decision-making. In contrast, Barclays has rejected the government’s recapitalization plan for the bank, saying it would, instead, raise GBP 7 billion and cancel its quarterly dividend to raise GBP 2 billion. The Bank also plans to raise more than GBP 6 billion in preference and common shares. On October 8, HMG had indicated that it stood ready to partially nationalize seven UK banks, including Barclays, by investing GBP 50 billion in preference shares, ordinary shares, or permanent interest-bearing shares.

Waiting to Exhale

-----------------

¶3. (C) Although stock prices have made some gains, and inter-bank lending has started - though just a trickle in volume - industry leaders believe it would be premature to call the crisis over. Gary vonLemden, Corporate Head, Europe, Citigoup (Please protect), told econoff that the rescue plan will not directly move to re-open the bond and commercial paper markets, and until they re-open, banks will be remain under pressure. There has not been a single corporate bond issue since August, he stated. “The government’s scheme protects the taxpayer and is likely to make money. It will also make finance easier to obtain that it would otherwise have been. Whether that gets immediately in market prices, whether on inter-bank or retail lending, is harder to judge,” observed Ben Broadbent, chief economist, Goldman Sachs. Even the Chairman of the Treasury Select Committee, John McFall, has expressed concerns that the GBP 37 billion being injected into three of Britain’s largest banks, might not be enough. “It is a minefield we are tiptoeing through,” he stated, and called on banks to provide greater detail of their exposure to derivatives and other complex assets.

¶4. (SBU) Others are concerned about the macro-economic situation. Inflation has jumped to 5.2 percent in September, above the BOE expected 5 percent rate and significantly above the two percent target rate. Surging household utility and food prices were the key factors behind this jump. The declining price in oil is expected to bring inflation down below the five percent mark in October, but inflation will remain a significant concern. In September, unemployment recorded its biggest rise in 17 years, jumping by 164,000

LONDON 00002603 002 OF 003

workers to 1.79 million, the largest rise since 1991. The weakening global economy is also affecting the UK’s trade deficit. Although it narrowed slightly in August to GBP 4.7 billion from GBP 4.8 billion, the gap was GBP one billion higher than analysts had expected. The effects on the real economy have also to become evident: car sales were down 21 percent in September alone and house repossessions are set to rise by 50 percent to 45,000 this year.

A New Dawn For Brown

--------------------

¶5. (SBU) After a year of plummeting poll numbers and questions about his ability to lead, Gordon Brown is suddenly riding high. On October 13, the same day that he was awarded the Nobel Prize for Economics, Paul Krugman published a New York Times op-ed entitled, “Gordon Does Good,” praising the PM and his team for his quick actions to stave off a further collapse of the financial industry and to lay down the foundation for a new global financial system. Brown’s plan to recapitalize banks, first announced on October 9, and then fine-tuned over the weekend was heralded by Krugman and many others as the missing element in all previous rescue plans - and a step subsequently adopted in several other countries. Brown has also received praise for riding to the rescue of the European Union. President of the European Commission Barroso told the media October 14: “We needed a global solution for a global problem and we ended up with what I will call the ‘Brown plan’...The UK was amongst the first to propose comprehensive plans for working together in Europe.”

¶6. (C/NF) Brown and Labour are up in the polls: a YouGov/Sunday Times , poll released on October 13 showed Labour popularity at 33 percent, up 3 points, and the Conservative Party at 43 percent, down three points. Brown and his economic team were also judged as better able to handle the crisis than their Tory counterparts. Even Tory political leaders are ruefully acknowledging Brown’s achievements. At an Ambassador-hosted breakfast for NY Times journalist Tom Friedman on October 14, Gregory Barker, MP, Shadow Minister for the Environment, stated that if Brown were to successfully stabilize the economy, he would not be surprised if the PM called for early elections, to try to capitalize on his helmsmanship of the economic recovery. This sentiment was echoed by Labour MP Jamie Reed, who told emboff privately that the government could call elections as early as spring of 2009, and would unlikely wait until the term ends in 2010. He did give a caveat, stating that election planning remained in flux, and noting that discussions on timing were ongoing.

Consensus For Now - But The Gauntlet Is Laid Down

--------------------------------------------- ----

¶7. (C/NF) The Tories have expressed support for the bail-out package, acknowledging that there was no other option when faced with the collapse of the banking system. “Now was the time for all political leaders to be bi-partisan,” stated Barker, and “the Tories have told the PM he has their support for the financial measures recently announced.” However, when the dust settles, he argued, it will be time to take a hard look at how “we got to this position, how do we get through the crisis stronger and better, and what can we achieve realistically in the longer-run?” The Labour Party is particularly vulnerable on the first part of that question, he contended, and pointed to improper regulatory oversight among the many perceived failings of the Labour government. He added that the challenge for everyone, now and in the immediate future, is to determine the right strategy for getting through the crisis and then to tackle the real problems brought on, or aggravated by, the crisis: a greater debt burden, collapsed housing prices, higher inflation, greater personal bankruptcies. This “is no moment of triumph for the government - for it is the British people who have now been landed with the bill for the boom that turned to bust,” recently remarked George Osborne, Shadow Chancellor.

Comment

-------

¶8. (C) Reaction in London to the U.K. economic rescue plan has been more muted than expected, with the stock market down nearly 3 percent in trading the morning of October 15th. Skepticism remains whether the measures adopted will be

LONDON 00002603 003 OF 003

sufficient to unlock paralyzed inter-bank lending and to start restoring credit in the faltering financial system. The U.K. government and investors are also watching closely the U.S. response to the crisis and the effect of the U.S. plan on both Wall Street and Main Street. U.K. officials have little room to maneuver should the rescue plan prove to be inadequate, since they have adopted measures that were to be called upon only in extremis. A worsening of the crisis would be bad news for the PM, who is enjoying a brief respite from the bashing he has received regularly in the press. While Labour’s poll numbers are slightly up, the Tories would still win a majority if the elections were held today.

Visit London’s Classified Website: http://www.intelink.sgov.gov/wiki/Portal:Unit ed_Kingdom

LEBARON